Many Americans already know about identity theft, which occurs when someone takes your personal information, like your address, credit card number, and Social Security number, and carries out fraudulent transactions in your name. But that’s not the only type of identity theft you might encounter. In fact, if you’re unlucky, you might be the victim of employment identity theft.

But what exactly is employment identity theft, and how does it happen? More importantly, how can you protect yourself against it? This guide will break down the answers to these questions and more.

Employment Identity Theft Explained

Employment identity theft, in a nutshell, is the use of a person’s personal information to apply for and work jobs. For example, an identity thief may scoop the information from a person using a cyber attack or by stealing their Social Security number in another way, then apply for and get a job for remote work using that information. They earn money under the identity theft victim’s name, then abandon the identity when they get what they want.

Put another way, employment identity theft is any identity theft where the point of the theft is to use the victim’s credentials for employment purposes. It’s contrasted with “standard” identity theft only because most normal identity theft occurs out of a desire to sell the victim’s information on the black market.

Is Employment Identity Theft Illegal?

Yes. Employment identity theft is always illegal. Once reported, organizations like the Federal Trade Commission (FTC), Social Security Administration (SSA), and Internal Revenue Service (IRS) will work with the victim in order to correct the record and alleviate any negative effects the victim may experience.

Effects of Employment Identity Theft

Unfortunately, employment-related identity theft can lead to a wide range of negative effects, some of which are short-term and some of which can follow the victim for years.

For example, a victim of employment identity theft may find that the thief used their information to not only acquire employment but also to open up several lines of credit and to acquire various bills. Over months, the identity thief doesn’t pay down the credit or bills, resulting in damage to the victim’s credit score in the eyes of the three major credit bureaus: Experian, Equifax, and TransUnion.

As another example, a victim of employment identity theft may be terminated from their current place of employment if their employer finds out that they have been applying to or working at competing jobs, even if it wasn’t really them. The victim may need to explain the situation quickly and prove their innocence in order to keep their job, which can be very difficult to do.

No matter what, employment identity theft always results in anxiety, major headaches, and long-term frustration as victims work to resolve the issue.

How Does Employment Identity Theft Happen?

This form of identity theft can happen under a variety of circumstances. Here are some examples.

Employer Uses Inaccurate Credentials

One way in which employment identity theft can happen involves an employer hiring someone with inaccurate or stolen credentials. They may interview an employee, find that they have a Social Security number, driver’s license number, and other key information, and hire them assuming that they are hiring the person they claim to be. This can happen if they don’t do a comprehensive background check, including a check of bank account info and a check of an applicant’s credit report.

However, later on, they determine that the credentials used were false or inaccurate in some way. When they go to investigate, the identity thief vanishes or flees, leaving the employer confused as to who they really hired and who they inadvertently hurt in the process.

Applications for Limited-Term Job Offers

Many organizations and industries offer limited time job opportunities for short-term work, usually at distant worksites and for periods of between three months and two years. Those with criminal records or other reasons not to apply to jobs with their real information may steal the identities of the victims, then apply to these limited term job offers in the hopes that their crimes will not be noticed until the jobs are done.

Employment Identity Theft by Colleagues

Additionally, victims may experience employment identity theft because of their coworkers or colleagues. A jealous colleague, for example, may voluntarily steal the information of a coworker who received a promotion during a data breach, then sell the information on the dark web.

Alternatively, they may use the credentials of a victim to perform fraudulent or harmful workplace actions in the hope of framing the victim in some way. Such scenarios are not very common, but they can happen if you aren’t careful about who knows your personal information and who has access to key workplace terminals/information.

Ways to Guard Against Employment Identity Theft

Fortunately, employers and employees alike can both guard against employment identity theft by following several secure strategies.

ID Theft Protection for Employees

As an employee, there are lots of ways to keep your identifying information safe, including:

· Always keep your personally identifiable information confidential, particularly your Social Security number. Don’t voice your SSN in public and keep your Social Security card at home unless you need to take it with you

· Similarly, don’t store any personal information on your work computer, including passwords, your personal email address, debit and credit card info, tax return info, and so on

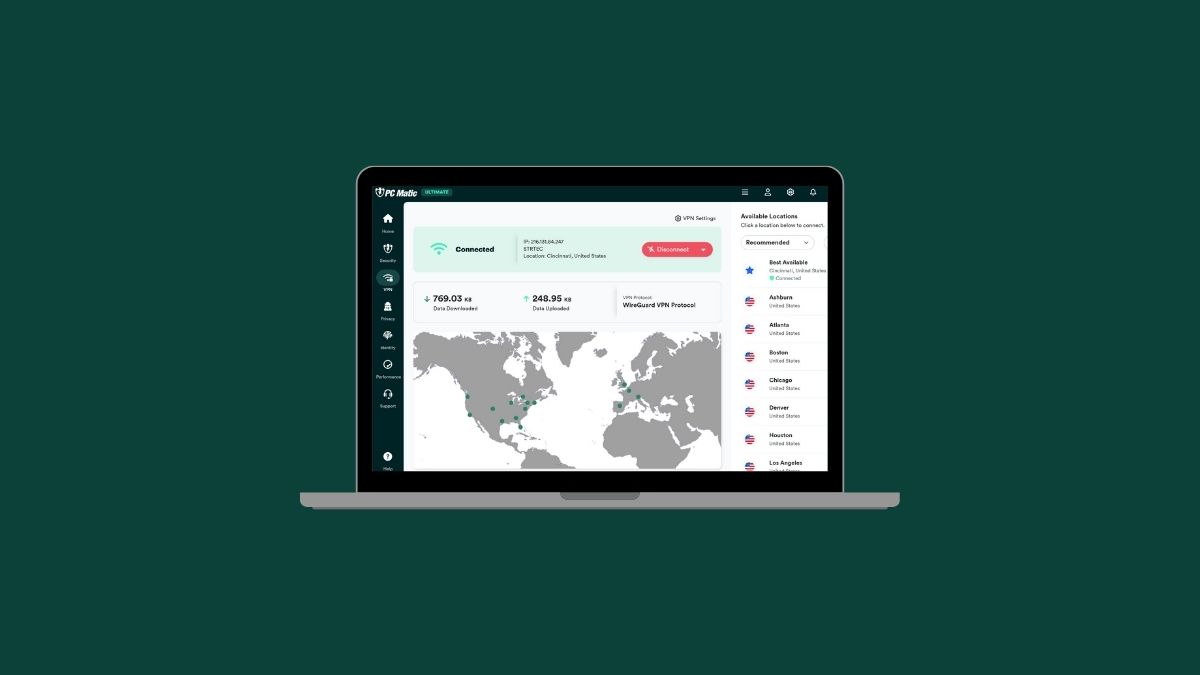

· Always be cautious when using public Wi-Fi networks. If possible, use a VPN in order to mask your IP address

· Stay aware of and avoid phishing scams. These are email based cyber attacks that occur when someone uses an email or text to trick you into providing financial or other personal information. These types of messages often appear to come from a legitimate source, but really mask an attempt from a cyber criminal to get your personal info

· Utilize cybersecurity software at your workplace terminal and at your home computers. Security software can prevent malware and other malicious software from being installed on your devices, thus keeping your personal identifying information safe

· Try to lock your Social Security number with E-Verify, a US government service that enables government services and employees to verify your identity and employment eligibility. E-Verify also lets you lock your SSN, which prevents employers from hiring fraudulent job applicants

It’s always best to practice these before you become the victim of identity theft. While it’s possible to reclaim your identity and get out of any credit damage or debts that may have been made in your name, it’s a lot of work to do so, and you may not be able to recover fully.

Instead, practice these tips ASAP to keep your personal information secure at all times.

ID Theft Protection for Employers

If you’re an employer, you can take steps to protect your employees against employment identity theft by following strategies like these:

· Train your employees to recognize cyber attacks and identity scams, like phishing scams, through seminars and mandated workplace training. This is good for your overall cyber hygiene as well, as it will help your business stay safe and secure against digital attacks

· Be sure to use workplace firewalls and to implement other digital security best practices. Encrypt vital employee information and don’t store employee information on any computers that are connected to the Internet

· Try to screen new employees and handle sensitive information properly. For example, you should minimize the number of employees who have access to other employees’ personal data. Always screen new candidates carefully by double checking Social Security numbers and other information. That way, you won’t accidentally contribute to employment identity theft or hire a fraudulent employee

· Offer your employees identity theft protection as one of your benefits. Theft protection services can help victims intervene quickly and alert them when their sensitive information appears somewhere online. Fraud alerts can also connect directly to government agencies to facilitate a fast response. These are great benefits both for your employees and you since you’ll save money by not hiring fraudulent employees in the first place

In the end, integrating and implementing these strategies will benefit your bottom line in more ways than one. You’ll inspire more confidence in your employees, plus save money since you won’t hire bad employees and have to replace them with new ones sooner rather than later.

Wrap Up

Ultimately, employment identity theft can happen to anyone. But by taking the right preventative steps, you can minimize the likelihood that you’ll ever experience this or have to deal with frustrating situations with the IRS and credit bureaus. Keep these tips in mind, and remember to keep your work ID information safe and secure at all times!